Chip Royce, Flywheel Advisors

A concerning trend is accelerating among closely held companies generating between $5M and $50MM in annual revenue.

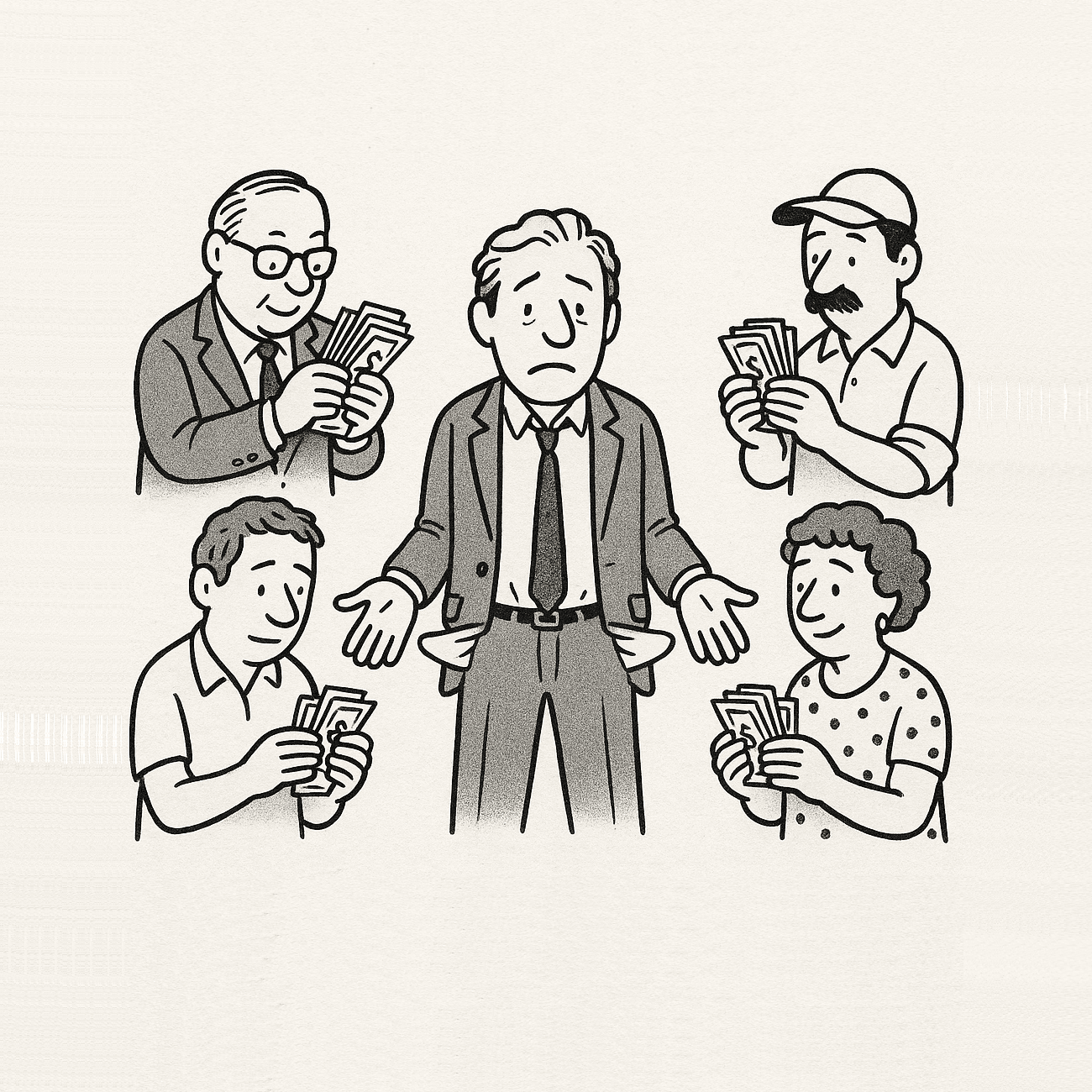

Many owners and CEOs inadvertently operate their businesses like non-profits rather than the profit-generating enterprises they intended.

This phenomenon, the “accidental non-profit”, occurs when business owners gradually shift priorities, focusing on employee satisfaction, customer happiness, and vendor relationships at the expense of shareholder returns and profitability.

The Hidden Crisis of Mid-Market Closely Held Companies

As the owner of a closely held company, you started your business with clear profit objectives. Perhaps it was a family enterprise passed down through generations, or maybe you built it from scratch with a small group of trusted partners. Regardless of origin, the business was established to generate returns for you and any co-owners.

Yet somewhere along the journey from startup to established mid-market company, priorities shift. Owners become increasingly focused on:

- Maintaining employee satisfaction and avoiding difficult conversations about performance

- Accommodating customer demands even when unprofitable

- Creating comfortable work environments that prioritize harmony over accountability

- Supporting vendor relationships that may no longer serve the business optimally

- Avoiding difficult financial decisions that might create short-term discomfort

The result? Companies that technically operate as for-profit entities but functionally behave like non-profits, serving everyone except their shareholders.

Why This Happens in Closely Held Businesses

The shift toward an “accidental non-profit” mindset occurs for several reasons unique to closely held companies in this revenue range:

1. Personal Relationships Cloud Business Judgment

In closely held companies, especially family businesses or those with a tight-knit ownership group, personal relationships often become entangled with business relationships. When the CFO is your brother-in-law or your top sales executive coached your son in Little League, making purely business-driven decisions becomes emotionally complex.

2. Success Creates Complacency

Many closely held businesses in the $5M-$50MM range have achieved a level of success that provides comfortable lifestyles for their owners. This comfort can breed complacency, reducing the drive to maximize profitability once personal financial needs are met.

3. Lack of External Accountability

Unlike publicly traded companies that face quarterly scrutiny from shareholders, closely held businesses operate with less external pressure for financial performance. Without these accountability mechanisms, it’s easier to drift from profit-focused decision-making.

4. Cultural Drift Over Time

As businesses mature and grow beyond the founding team, company culture often shifts from entrepreneurial and profit-driven to more collaborative and stakeholder-focused. While this evolution has benefits, it can dilute the profit orientation that built the company.

5. Misaligned Compensation Structures

Many mid-market businesses develop compensation systems that reward activities not directly tied to profitability. When incentives aren’t aligned with bottom-line results, the whole organization gradually shifts away from profit maximization.

The Financial Cost of Being an Accidental Non-Profit

The financial impact of this phenomenon is substantial but often hidden from view. Research has shown that closely held businesses operating with unclear profit priorities typically underperform their profit-focused counterparts by 15-25% in terms of profitability margins.

For a $20 million company, this means leaving $750,000 to $1.25 million in annual profits on the table, money that could be reinvested in growth, used to create financial security for the owners, or distributed as returns to shareholders.

- Reduces business valuation, should owners wish to sell

- Creates vulnerability during economic downturns due to thinner margins

- Limits growth potential due to suboptimal capital allocation

- Increases dependency on key customers or suppliers

- Diminishes the company’s ability to attract outside investment if needed

The Warning Signs of the Accidental Non-Profit

How can you tell if your business has drifted into accidental non-profit territory? Look for these warning signs:

1. Rediscover Your Owner’s Vision

Start by reconnecting with why you own this business in the first place. Beyond providing a livelihood, what financial goals drove you to take on the risk and responsibility of ownership? Document these objectives clearly and share them with your leadership team.

2. Implement Profit-Focused Decision-Making Frameworks

Create a formal decision-making process that explicitly considers profitability impact. Require all major decisions to include an analysis of:

- Short and long-term profit implications

- Return on investment expectations

- Opportunity costs of capital and resources

- Clear accountability for financial outcomes

3. Restructure Manager Compensation

Align incentives throughout the organization, starting at the top. Ensure that executive compensation is directly tied to profitability metrics, not just revenue growth or subjective measures. Consider implementing:

- Profit-sharing programs tied to bottom-line performance

- Equity or phantom equity programs that create ownership thinking

- Bonus structures that require minimum profitability thresholds

4. Make Profitability a Core Cultural Value

Culture doesn’t just happen. Culture is deliberately created.

Make profitability an explicit cultural value by:

- Regularly communicating profit expectations and results

- Celebrating profit achievements as enthusiastically as other successes

- Creating transparent metrics around profitability goals

- Training managers to make and justify decisions based on profit impact

5. Implement Regular Financial Discipline Reviews

Institute a quarterly “profit discipline” review process where you examine:

- Customer profitability analysis (identifying which customers generate or drain profit)

- Product/service line profitability

- Employee productivity relative to compensation

- Overhead allocation and efficiency

- Capital allocation and returns on invested capital

6. Rightsize Your Operating Model

Many closely held businesses grow organically without intentionally designing their operating model. Take time to:

- Evaluate your organizational structure for inefficiencies

- Assess if you have the right talent in the right roles

- Determine if your physical infrastructure matches current needs

- Review if your systems and processes are helping or hindering profitability

7. Create an Owner’s Board

Even if you don’t have legal fiduciary duties to a formal board, create an advisory group that meets quarterly and brings an external perspective and accountability to your business. Include:

- Other successful business owners

- Financial experts

- Industry veterans

- Professional advisors (accountants, attorneys, consultants)

Case Study: From Accidental Non-Profit to Purposeful Profit Machine

Consider the example of Midwest Manufacturing, a second-generation family business with $35 million in annual revenue. The company had been stable for years but struggled with consistently thin margins around 4% when industry leaders achieved 12-15%.

The turning point came when the CEO realized the company had been prioritizing employee tenure over performance, accepting unprofitable customer relationships to “keep the factory busy,” and avoiding difficult conversations about underperforming product lines that family members had developed.

- Improved profit margins to 11%

- Reduced the customer base by 15% while increasing revenue by 8%

- Restructured the leadership team with clear profit accountability

- Created a succession plan that included performance-based equity transfers

- Built a cash reserve that allowed them to weather industry downturns

The CEO later noted, “We realized we were running the business like a community service rather than the profit-generating enterprise my father had intended. Refocusing on profitability didn’t just benefit the shareholders—it created more security for our employees and better service for our best customers.”

Conclusion

Running an accidental non-profit isn’t just bad for shareholders, it’s ultimately unsustainable for employees, customers, and vendors. True sustainability comes from profitable operations that create lasting value for all stakeholders.

By recognizing the signs of an accidental non-profit, restructuring decision-making processes, realigning incentives, and refocusing on profitability as a core value, owners of closely held businesses can reclaim their for-profit status and build truly sustainable enterprises.

Remember, profitability isn’t just about enriching owners, though that’s a legitimate goal. Profitability provides the resources needed for innovation, growth, employment stability, and ultimately the continuation of the business itself. By prioritizing profit, you’re not just serving your interests—you’re ensuring the business can continue to serve all stakeholders for generations to come.

The path to stakeholder satisfaction paradoxically begins with a clear-eyed focus on profitability. For closely held companies in the $5M to $50MM range, this means intentionally designing the business to serve its owners first, confident that doing so creates the foundation for serving everyone else.

Flywheel Advisors transforms accidental non-profits back into the profit machines they were meant to be.

We’ve spent two decades showing business owners how to stop feeding everyone else first and start putting their own financial interests back at the center of their companies.

Whenever you’re ready, there are 3 ways we can help:

1) Schedule 25 minutes to chat about your businesses: new opportunities, current challenges, aspirations, pretty much anything!

2) Sign up (if you haven’t already) for this newsletter.

3) Read back issues for more insights into how to (re)ignite growth for your company.