Chip Royce, Flywheel Advisors

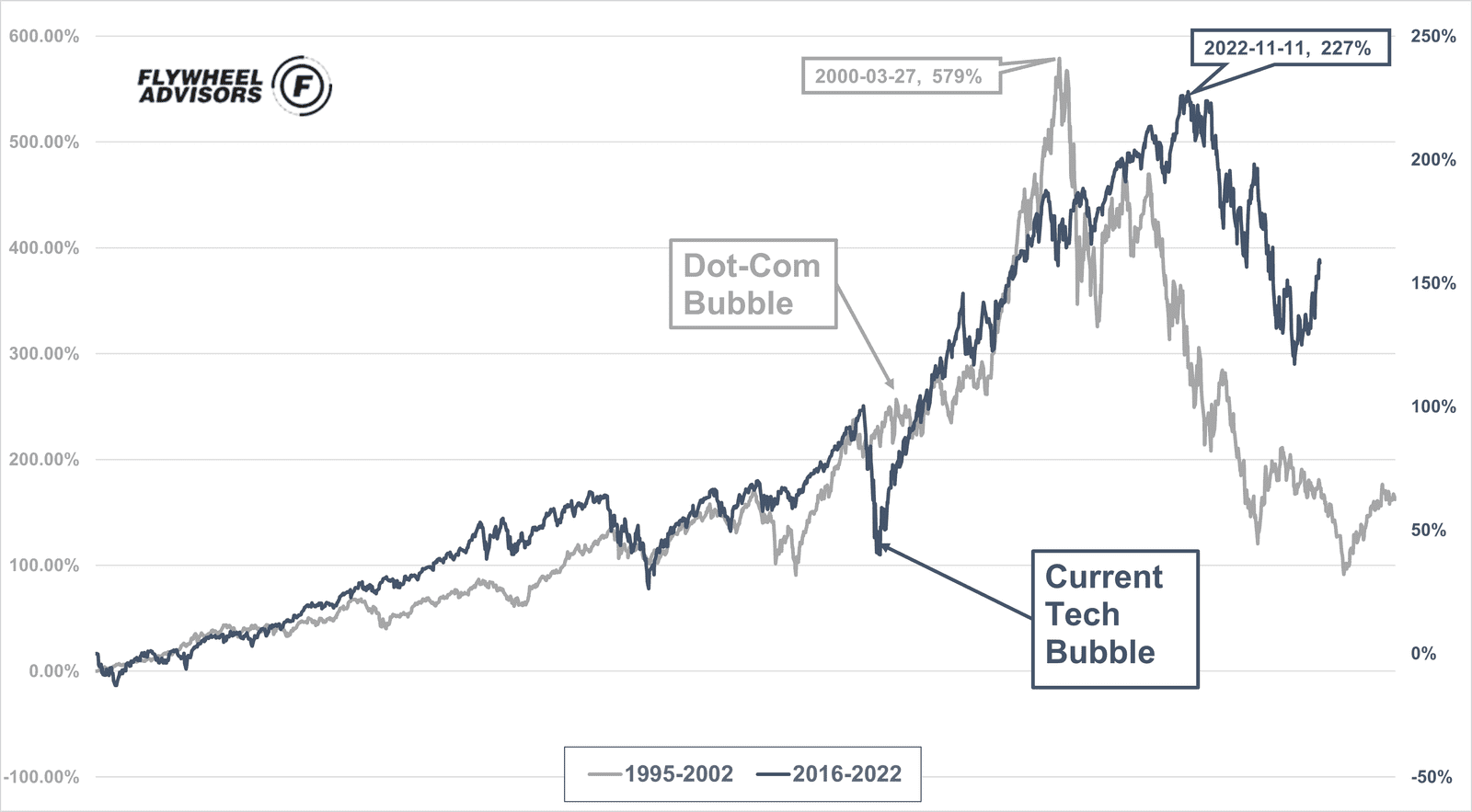

In 2015, the Federal Reserve started a significant reduction in the fiscal stimulus it provided to the US economy. In 2015 the tech sector and venture investments were at all-time highs, and many experts suggested we were in a “startup bubble” likely to pop and lead to negative impacts on the private and public tech sectors.

The correlation between this stimulus, the public technology sector (as represented by the NASDAQ stock index), and venture investment is quite strong. Logic suggested that private, venture-backed, and bootstrapped companies may have to ‘buckle down’ and prepare for winter, a period of difficult business conditions, and hard-to-obtain financing from either venture or traditional sources like bank credit lines.

As it turns out, 2015 did not lead to an implosion in the tech sector as the Federal Reserve reversed course and continued various rounds of ‘Quantitative Easing”.

If you thought 2015 was frothy, the tech sector became seriously overheated into 2019. The pandemic of 2020 and the fiscal stimulus that came with it seemed to delay any problems in the tech sector.

Now it’s 2022, and while this article is a little late to be updated from my original 2015 post, inflation has been rising. The Federal Reserve has announced its intentions to reduce its balance sheet and raise rates, and the NASDAQ 100 index is down around 20% from its all-time highs.

Regardless, many start-ups may have not yet felt any pain or yet gone to seek additional capital in what may be difficult times.

Here are my Six (updated) steps to surviving a startup tech bubble.

Here are my Six (updated) steps to surviving a startup tech bubble.

- Get Profitable

- Cash (and Credit) are King

- Redefine Success

- Calibrate Expectations to the Market

- Team Alignment More Important Than Ever

- Know Thy Customer

1. Get Profitable

When the economy suffers and investor risk tightens, so do the GPs who invest in these funds. Your investors will have difficulty raising new money or may raise their investment criteria.

Sure, your investors said ‘grow-big, fast’. You ran at a loss to gain share and customers and grow top-line metrics. That was low-risk when your investors stroked big checks to you to back your growth, and you had leverage.

There’s no better way to not worry about investor follow-on investments than to buckle down, find a way to break even or better, and ensure your company can survive to fight another day.

2. Cash (and credit) are King

In inflationary circumstances, that is even more important as manufacturing and other companies that hold inventory have incentives to pre-purchase commodities and components to ensure supply chain stability and capture lower costs in a rising cost environment.

Manufacturing companies are especially dependent on sources of credit to float their operations and inventory. In a declining economic environment, banks are likely to increase their lending standards, raise rates, and be very stingy. Make sure you have all the credit you need BEFORE the economy turns and banks turn off the credit spigot.

3. Redefine Success

This is related to becoming profitable, but the economic climate has changed. “Grow big fast” may no longer be an appropriate strategy. The IPO window may be closed for the foreseeable future, and acquisition at a desirable valuation may not be in the cards.

This can impact company morale, including within the leadership team.

4. Recalibrate Expectations to the Market

It is easy to be complacent and harbor sky-high expectations for your company, valuation, and exit potential when:

- The NASDAQ is up 25% on the year

- New unicorns are being minted each month, and you can quickly raise a new VC round at any valuation you choose

- Possible acquirers are calling monthly to ‘stay in touch’.

However, once the market cools, startup executives must adjust expectations until the ‘froth’ returns to the venture marketplace. If you have to raise a new round, you’ll need a more sober understanding of valuation and terms.

5. Team Alignment is More Important Than Ever

There are many adages about knowing who your friends are in tough times. The same goes for both your leadership team and your key employees. Once the market slows and exit opportunities diminish, it is even more important to 1) ensure trust and alignment with your leadership team and 2) continue to build morale and ensure two-way communication with your workforce. The last thing you want in tough times is to see your team walk out the door during the first sign of trouble or challenges ahead.

6. Know Your Customer

So many entrepreneurs will profess admiration for their customers but only see the customer as part of a one-way transaction and source of income.

It is important when times are good to treat customers well, build long-term, sticky relationships, and solicit feedback. It is those relationships that will benefit you during tough times.

These customers may turn out to be your loyal customers and your foundation of revenue and referrals that you can count on, which may just keep the lights on during the most difficult days of your business.

Parting Thoughts…

The purpose of this post is not to create FUD (fear, uncertainty, or doubt) in your mind for an upcoming or current economic shock.

Instead, I see these discussions as a way to encourage thoughtful, strategic thinking for executives and managers. Similar to Aesop’s fable of the “Grasshopper and the Ant,” your company’s preparation for a natural economic cycle can become a strategic advantage. Instead of being the Grasshopper and starving, you can be the Ant and thrive during uncertain times.

Whenever you’re ready, there are 3 ways we can help:

1) Schedule 25 minutes to chat about your businesses: new opportunities, current challenges, aspirations, pretty much anything!

2) Sign up (if you haven’t already) for this newsletter.

3) Read back issues for more insights into how to (re)ignite growth for your company.